Thinking of buying a house, an apartment, or a piece of land in Sydney? If Yes, in this post you’ll all the things to be noted before buying a house in Sydney NSW areas.

This step-by-step process helps to get your dream house where you can stay with your family.

Sydney, a beautiful city in the world with the bluster of year-round sunshine, stunning harbor views, and gorgeous.

You can’t stop craving the thought of living here and enjoy the unique Sydneysider lifestyle and experience that can be only found in this city.

But the struggle for properties here is vicious, moreover, buyers are pulling out all cards just to secure their property.

If you are one of them, however, don’t know about the things that need to be considered before buying a house in Sydney.

Our team is here for you..! Metro Homes & Partners has over 20+ professional agents, has a relationship with construction, hardware, furnishing companies, and has decades of experience in the industry. We can assist you in buying properties in New South Wales.

Make sure you read the entire article, so you can know everything a buyer should know before buying a house in Sydney NSW areas.

So, grab a pen, open a notebook and let’s start writing steps together for the things to be noted before buying a house in Sydney.

Step 1: Things to know before buying a house in Sydney Australia

After the hit of the COVID pandemic over the world thankfully, the Australian market is heading back in the right direction and still providing affordable chances on the house/property to the buyers.

A great opportunity to grab the desirable property for you or first home buyers to stamp duty relief.

However, with a great property possibility, buying a house is one of the costly investments that you will ever make in your entire life.

Yet, you can manage your expansion and time-consuming process by minimizing your investment by being as prepared as possible.

Keeping everything in mind, here are some things to be noted before buying a house in Australia’s Sydney or elsewhere.

- When buying a home, keep the following question and try to give your comfortable answer:

- Think about where you wish to live?

- Is the house close to vital comforts?

- Is the number of rooms in the house sufficient for your requirements?

- Are the structure of the building and the roof sound?

- What are the noise levels like in your neighborhood?

- Is there enough natural light in the house?

- Is there enough power in the house?

- Is there any evidence of termite infestation?

- Is there anything planned in the area?

- Is the garden appropriate?

Step 2: What to look for when buying a house

Buying a dream house in Australia or anywhere else is full of curiosity and needs a sense of a dog’s nose. A single step can lead to the wrong path and drag you into uncertainty.

“So, calm down! take a step back and make sure to note down things with reasonable, well-researched, and thoughtful prospects, rather than an emotional or hasty one.”

What to look for when buying a house, with that in mind, here are eight things you should know about the things to be noted before buying a house.

Is this a property you can truly afford?

Plan your budget around your house loan payments and stick to it for three months, remembering to set aside money each month for upkeep.

That way, you won’t have to worry about your mortgage becoming a burden, and you’ll be free to live your life the way you want.

Investigate the surrounding area. Do your satisfied more self-research:

To obtain a feel of what’s going on in the neighborhood, talk to real estate agents and your mortgage broker.

Make sure you understand how properties are evaluated and how that compares to the list price.

Take the time to inspect the property for any concerns:

Is the toilet flushing correctly? Is the heating/cooling system operational? Is the flue above the fireplace working?

Is the water pressure sufficient? Do the appliances function properly? Is the studio in the back of the house approved by the city council?

Ask lots of questions, and don’t be hesitant to keep asking.

Collaboration with an experienced pro:

Consult a mortgage broker to ensure that your financing is tailored to your needs, and speak with a financial advisor about the reality of homeownership.

Make sure your lawyer isn’t also representing the seller to avoid a conflict.

Instead of following your heart, use your brain:

“Take your brain with your heart…!”

Following your heart can lead to a lot of positive things in life. We suggest one of them is rarely property ownership.

Negotiate as much as possible without feeling rushed:

If the agreement isn’t right, don’t be scared to walk away. Other properties will be available.

Keep in mind that this is a business transaction, and you must adhere to the conditions.

As a buyer, you should feel in possession and as if you have nothing to lose by engaging in aggressive bargaining.

Make sure you’re negotiating as hard as you possibly can.

Don’t put any strain on yourself.

They may put pressure on you to make an offer “before someone else snatches it up” to do this.

If you feel rushed, take a step back. If you take the time to think about it thoroughly and objectively, you’ll be less likely to make a mistake.

Step3: Understanding the process of buying a house, Australia

You may have already deduced from this post that purchasing a home necessitates a high level of self-assurance above all else.

Congratulations on your decision to buy a house in Sydney!

However, if this is your first home buyer, or if it has been a long time since you have acquired a property, or if you have previously purchased in another state, you may feel won but there’s always hesitant about starting.

There are about 5 important procedures to do or things to be noted before buying a house in Sydney:

Organize your financial situation

Calculate the repayments for the amount you can borrow after you know how much you can borrow to ensure you can make the payments – the amount you can borrow may not be within your means to repay!

This is a crucial initial step; you don’t want to fall in love with a home only to discover it’s out of your financial range later. Or, even worse, you buy the house only to discover you can’t afford it.

Make a proposal

When you decide to make an offer on a home, you should ask the agent to provide you with a copy of the selling contract.

This contract is a legal agreement that formally identifies the property being sold and contains several key property documents.

You should give this contract to your conveyancer or solicitor to review and make sure there are no major flaws or missing things that would prevent you from buying the property.

Organize the legal aspects

This is a legal obligation. Furthermore, both real estate agents and lawyers should have professional compensation insurance, which will protect you if any errors are made during the procedure.

When buying a house, whether you hire a lawyer or a real estate agent, they should undertake the following critical tasks:

Examine and evaluate the sales contract

- With the seller’s legal representative, exchange the sale contract.

- Make arrangements for payments like deposits and stamp duties.

- Make the mortgage contract.

- Examine any outstanding payments on the property.

- Arrange for a title change.

- Assist you with the settlement process.

Negotiate and secure with deposit

The transaction of a deal is what legally concludes the homeownership method when buying a house in Sydney.

You and the vendor (seller) will each receive a copy of the sale contract, which you must sign before they are exchanged.

This will be organized by your lawyer or real estate agent, and you will be needed to pay a deposit for the property at this time.

The deposit is typically 10% of the agreed-upon purchase price, although both parties can agree on a different amount, which should be recorded in the contract.

Step 4: Things to look for when buying a house checklist in Sydney Australia

There’s a lot to think about, so having a checklist will help you remember everything.

Here’s a handy checklist of things to be noted before buying a home in Sydney.

Finance checklist

The deposit is the first step in purchasing a home. The deposit is only the beginning of your out-of-pocket costs.

Estimate an additional 5% of the total purchase price to cover other expenses, such as:

- Fees for conveyancing or solicitors

- Inquiries or expenses (title search, etc.)

- Inspections for pests and property

- a survey of identification

- Inspection of strata records (if relevant)

- Stamp duty on title transfers and mortgages

- The application fee charged by the lender

- Fee for valuation

- Mortgage insurance is a type of insurance that protects (if required)

- Rates of the council are being adjusted.

- Insurance for your house and belongings

- Changes in locks, carpet cleaning, removalist fees, connection fees for various services, and expenditures

- related to any urgently needed repairs are all possible expenses.

Location Checklist

Your choice of the neighborhood will have a significant impact on how happy you are in your house.

Consider the following checklist question:

- What are the local property values like?

- What is the burglary rate in the neighborhood?

- What are the distances between the nearest shops, hospitals, restaurants, train stations, and bus stops?

- Have you checked with the local government to see if there are any major developments planned in the area?

Other factors to consider

- New road construction, as well as the proximity of factories, jails, or sewerage works, are all clear bad elements to be aware of ahead of time.

- Are there any nearby sports fields, bars, railroad stations, or other sources of noise?

Children’s facilities Checklist

If you have children, the proximity to good schools and other satisfactory stuff is also a factor to consider.

Consider this:

- What is their distance from you, and how will your children get there and back?

- Is public transportation easily accessible?

- Is there a train station or a bus stop within walking distance?

- Is the path safe for children to walk to and from school?

- Playground nearby?

- Nearby training and Learning Centers?

Transportation Checklist

Only roughly 1 in 10 Australians use public transportation to travel to and from work regularly. However, having buses and trains close to a new home can be beneficial.

When it comes to trains, the best location is one that is close enough to walk to but not so close that your home is subjected to constant train noise.

Others find that walking from their home to a railway station or bus stop is a less stressful mode of transportation than sitting in traffic in their car.

Appliances Checklist

One item that home purchasers may overlook is if the home’s built-in appliances are in good working order.

This includes the following:

- System of hot water

- Air conditioning, Stovetop Oven

- System of central heating.

- Just because certain appliances are included in a home doesn’t imply they’ll all function.

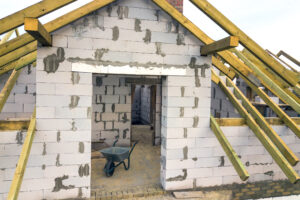

Building Inspection checklist

Have a complete building inspection performed by a licensed and insured specialist before you buy a house.

It’s important to note that a building inspection report is not the same as a pest inspection report (although some companies can perform both for you).

A building inspection will set you back a few hundred dollars, but it is well worth it. This is why:

- The soundness of the structure

- Detecting potential dangers

- Creating a repair budget

- Structures such as sheds, patios, and other structures

Home and Contents Insurance Checklist

Read the Product Disclosure Statement and Key Fact Sheet before buying house insurance to make sure you know what your policy covers.

If you’re uninsured, it could cost you a lot of money if your house is damaged by following. So, consider a checklist to inspect

- Storm-related damage

- A forest fire

- A burst pipe that floods the house, burglary, vandalism, or some other unforeseen disaster are all possibilities.

Long-term financial commitment Checklist

Real estate might be a smart investment in Australia because of the current housing crisis.

If you buy a house to rent it out, you might be able to produce a steady income stream or save money on taxes by using negative gearing.

A ‘must’ stage in your pre-purchase checklist study is to look into the tax treatment that will apply to you and your property.

Final thought

We hope you have known all the necessary things to be noted before buying a house in Sydney with the needed steps to be taken in 2021.

However, as time passes and the house requires maintenance, homeownership will certainly bring with it sudden costs.

As a result, in addition to your regular savings, you may want to consider setting up an emergency fund in an interest-bearing savings account to cover you if, breaks down and needs to be replaced.

For this purpose, you might be able to use a balanced strategy or a convenience facility.

So, let us know what’s your strategy and will you apply our recommended suggestion to buying your dream house.

Let us know through the comment section below. We love to read your thoughts and even it inspires us to keep the good work!

FAQ

What is the minimum deposit required to purchase a home in Sydney?

A 20% discount. Generally, banks and financial institutions would advise you to put down a deposit of at least 20% of the purchase price of your potential property. So, if we return to our $400,000 house, you’ll need to contribute $80,000.

What is the most excellent time of the year to buy a house?

August is the greatest month to buy a home. In general, buyers in the fall and winter have fewer selections but greater price flexibility, whereas purchasers in the spring and summer have more options but less negotiating leverage.

Is it possible for me to buy a home in Sydney?

Exclusive research has revealed that home buyers in Sydney’s hot property market now need to earn a six-figure wage to finance a mortgage on an average house or apartment.

At a house viewing, how should I act?

Show up on time. First impressions matter, so arrive on time and make a good first impression on the seller or listing broker.

Remove your shoes.

Do not be afraid to ask questions.

Don’t: Go to the bathroom.

Don’t forget to bring food.

Don’t Try to Negotiate While You’re at Home.

Don’t Bring Your Children or Pets.

Follow your instincts.

What is the cost to buy a house in Sydney?

The current median property price in Sydney is $1,027,962. If you want to buy a house with a low-deposit home loan (at 5%), you’ll need $51,398 as a down payment.

Will house prices in Australia fall in 2021?

House prices are rapidly increasing all around Australia. The majority of the factors that sustain house price growth are unlikely to persist by the end of 2021 and into 2022.